Flexible credit options.

Find your fit.

Earn up to 100,000 bonus Qantas Points.

Earn up to 100,000 bonus Qantas Points with the Bankwest Qantas World Mastercard when you spend $35,000 on eligible purchases within the first five months and keep your card open for 15 months. You must not have opened a Bankwest Qantas Mastercard in the last 24 months. Other fees and T&Cs apply.*

What you get with a Bankwest credit card.

Always in the know.

See what you’re spending in the app

No need to hunt for a transaction – see what you’ve spent across your accounts at a glance.

Stay on top of repayments

Check out your amount owing, and get optional alerts when your next repayment is due.

Tap and pay straight away

Add your card to your digital wallet, then spend instantly with Apple, Google or Samsung Pay.

Pay 0% p.a. for 4 months with Easy Instalments

Spread the cost of up to five eligible purchases over four monthly instalments and pay 0% p.a.§

Make purchases without using your regular card details.

Security taken seriously.

Lock your card from the app

Lock your card if you lose it or spot a suspicious transaction.

See if an account name checks out

When making a first-time payment, NameCheck shows you if an account name likely matches the account details based on our available payment data.

Manage your security

Change your pin and other security measures in the app.

No credit card annual fee with a Complete Home Loan Package.

Common questions.

If you have a credit card and you want to add someone else as an additional cardholder, you and the person will both need to fill out and sign the Additional Cardholder(s) Request Form (PDF).

Once you’ve finished, you can send this form to us at:

Cards Services

Reply Paid 8411

Perth BC WA 6849

If the person you want to add as an additional cardholder isn’t already banking with us, we’ll need them to be identified at an Australia Post outlet. See a handy list of ID documents we’ll accept.

Things to consider.

- There is a limit of one Bankwest Breeze Mastercard, one Bankwest Zero Mastercard, one Bankwest Qantas Mastercard, and one Bankwest More Mastercard per customer.

- Lending and eligibility criteria, fees and charges apply.

- Apple, the Apple logo and Apple Pay are trademarks of Apple Inc. App Store is a service mark of Apple Inc. Bankwest Apple Pay Terms of Use apply.

- Android, Google Play and the Google Play logo are trademarks of Google LLC. Bankwest Google Pay Terms of Use apply. Google Pay and Google Wallet are trademarks of Google LLC.

- Bankwest Samsung Wallet Terms of Use apply. Samsung and Samsung Wallet are trademarks of Samsung Electronics Co Ltd.

- Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

# Interest free days

You qualify for interest free days on purchases if you pay the closing balance owing (excluding any promotional or introductory balance transfer amount) on your current statement in full by the due date. Section 24 of our Credit Cards Conditions of Use (PDF) further outlines how this interest free period is calculated.

^ Earning Qantas Points

You must be a member of the Qantas Frequent Flyer program to earn and redeem Qantas Points. A joining fee usually applies. However, complimentary membership is available from Bankwest if you join at qantas.com/joinffbankwest. Membership and the earning and redemption of points are subject to the terms and conditions of the Qantas Frequent Flyer program. Qantas Points are earned in accordance with and subject to the Bankwest Qantas Rewards Terms and Conditions (PDF).

Qantas Points are earned on eligible purchases only. Most purchases are eligible purchases except some things such as balance transfers, bank fees, gambling, government charges and anything else listed in section 5 of the Bankwest Qantas Rewards Terms and Conditions (PDF). Exclusions and limitations apply. Points earned and redemption values subject to change.

Qantas Points (outside any bonus points) won't be transferred to your Qantas Frequent Flyer Account until:

- You have spent an initial $1,500 on eligible purchases using your card; and

- Your account has been opened for at least 2 months.

** Complimentary insurance

Complimentary overseas travel insurance provides base cover only. Limitations, exclusions, and eligibility criteria apply. See the Credit Card Insurances Product Disclosure Statement and Information Booklet (PDF) for details.

Coronavirus (COVID-19) Cover is available for overseas medical expenses incurred due to COVID-19. No cover is available under any other benefit or if you are travelling on a cruise. Terms and conditions apply. For more information please refer to the Credit Card Insurance PDS (PDF).

~ Earning More Rewards Points

More Rewards points are earned in accordance with and subject to the Bankwest More Rewards Terms and Conditions (PDF). Exclusions, limitations and points caps apply. More Rewards points will only be credited to your account once you have spent at least $1,500 on eligible purchases and your account has been open for at least 60 days.

Annual bonus points will not be available to Account Holders who open a Card Account after 31 July 2023. See Bankwest More Rewards Terms and Conditions (PDF) for more information.

* Bankwest Qantas World Mastercard Points offer:

Earn up to 100,000 bonus Qantas Points. Offer only available to eligible new Bankwest Qantas World Mastercard customers who:

- Both apply for and open (that is, activate the card we issue for) a new Bankwest Qantas World Mastercard on or after 22 November 2024.

- Have a minimum credit limit of $12,000 for that new Bankwest Qantas World Mastercard.

- Have not opened a Bankwest Qantas Mastercard account in the last 24 months.

- Offer is not available to customers who have switched from an existing Bankwest credit card to a new Bankwest Qantas World Mastercard.

Promotion details:

- Earn 80,000 bonus Qantas Points by spending $35,000 (minimum spend requirement) on eligible purchases within five months from account opening. If the minimum spend requirement is satisfied, your 80,000 bonus Qantas Points are transferred to your account within seven months from account opening.

- Earn 20,000 bonus Qantas Points automatically by keeping your account open for 15 continuous months from account opening. If this requirement is satisfied, your 20,000 bonus Qantas Points are transferred to your account within 17 months of account opening. Your card must remain open for bonus Qantas Points to be transferred.

Our Bankwest Qantas Rewards Terms and Conditions apply.

§ Easy Instalments

Lending criteria, fees and charges apply. Terms and conditions apply and are available on request. Available on eligible purchases between $100 and $10,000. Cash advances, gambling transactions, balance transfers, purchases on a promotional offer and purchases made more than 30 days prior aren’t eligible. You won't be able to apply for an Easy Instalments plan if you don't meet our eligibility criteria (e.g. if you've exceeded your limit or if you're in default). When you apply for an Easy Instalments plan, you are requesting an amendment to your allocation of payments in accordance with clause 6. of the Easy Instalments Terms and Conditions. To apply payments in this order may mean that other balances that attract a higher interest rate may be repaid later which may result in you paying higher interest charges.

¶ Complete Home Loan Package

No credit card annual fee applies when the card is taken out as an eligible card with the Complete Home Loan Package. Package consists of an eligible home loan, one optional eligible credit card per customer and up to nine optional Offset Transaction Accounts per loan. The Complete Home Loan Package is closed when all home loans included in the package are closed. Under the package, only one optional Bankwest Qantas Mastercard, Bankwest More Mastercard or Breeze Mastercard account is allowed per customer. Minimum credit limit is $3,000 for the Bankwest Qantas Platinum Mastercard, $1,000 for the Bankwest More Classic Mastercard and the Breeze Classic Mastercard, and $6,000 for the Bankwest More Platinum Mastercard and Breeze Platinum Mastercard, and $12,000 for the Bankwest More World Mastercard and Bankwest Qantas World Mastercard.

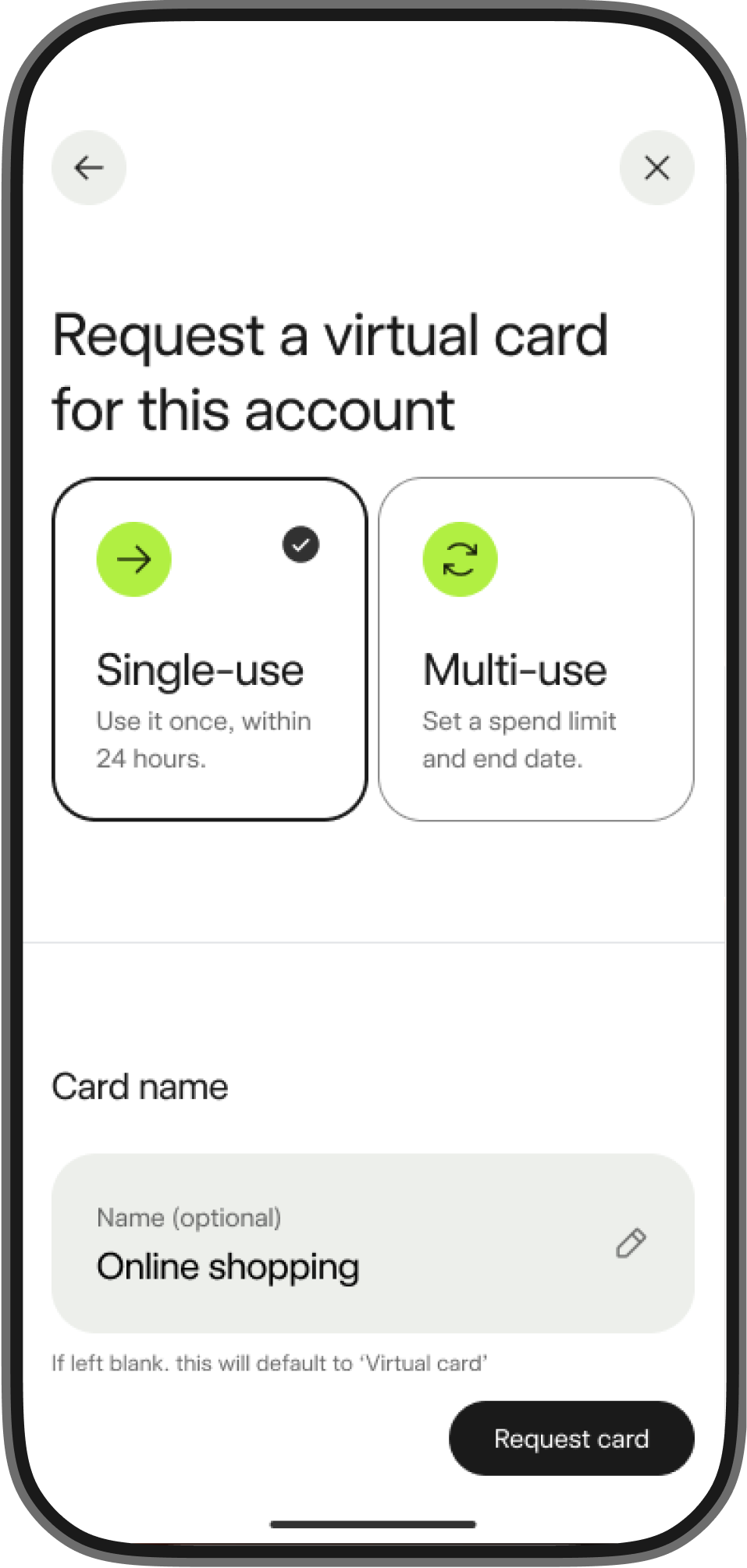

††† Virtual cards

Lending and eligibility criteria apply. See the Account Access Conditions of Use for your product.