Bank accounts to simplify your spending

Find your fit

- No fees

- No minimum deposit

- Earn interest on a linked Easy Saver account#

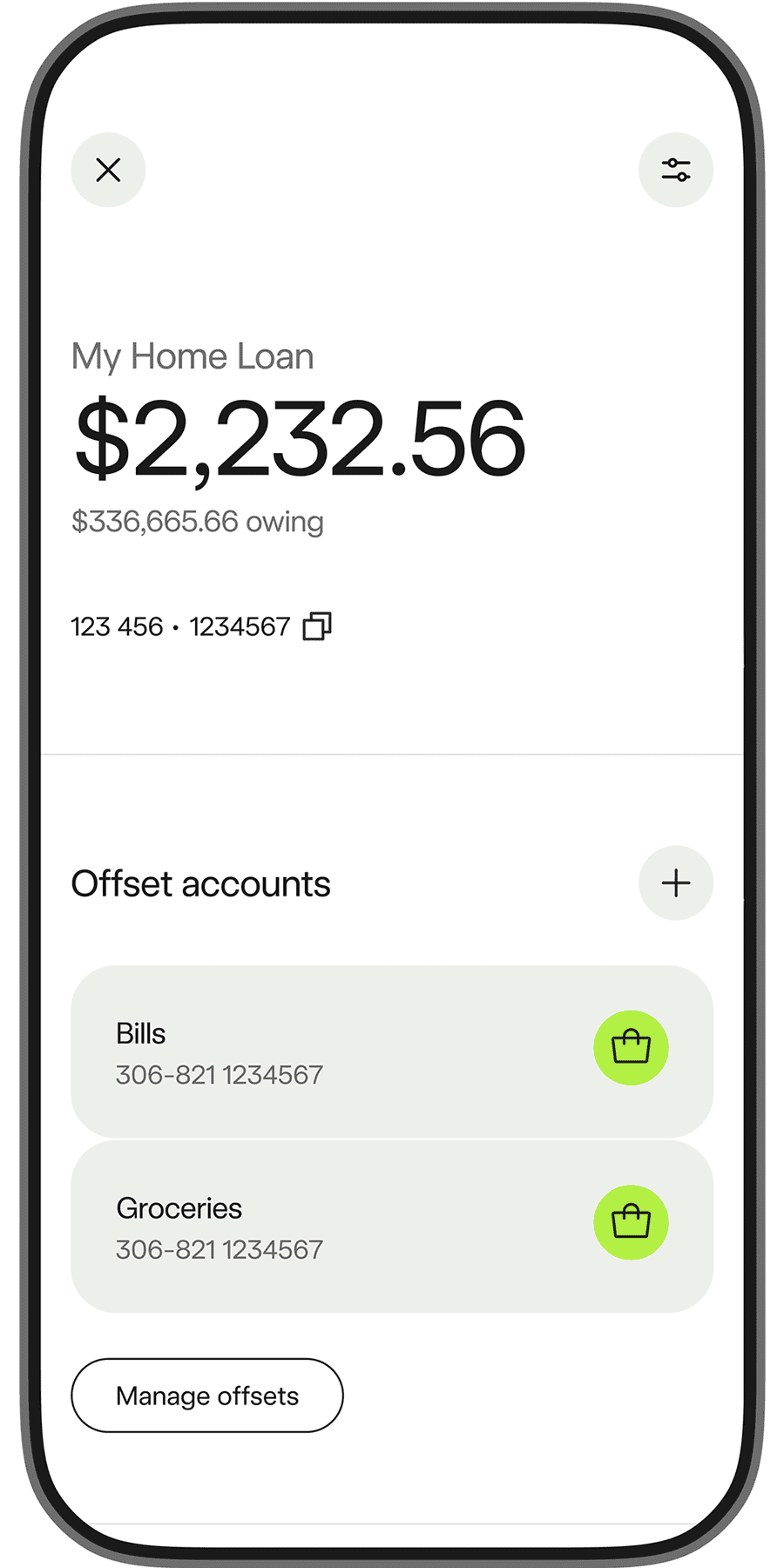

- Reduce your home loan interest‡

- Add a card for everyday spending

- Link up to nine offsets to your home loan

What you get with a Bankwest bank account

An app that keeps you in the know

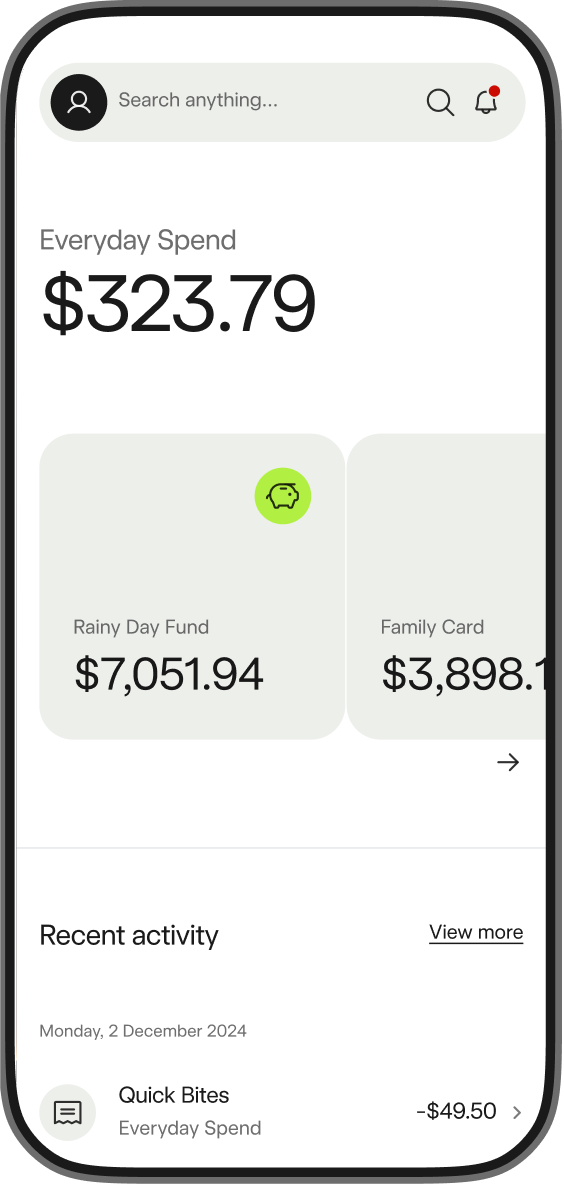

See things clearly across accounts

See your favourite account and transactions in a simple dashboard.

Know exactly where you spent

Transaction details that make sense and show where you actually spent.

Custom alerts for what matters to you

Know what’s going on with your money without having to log in.^

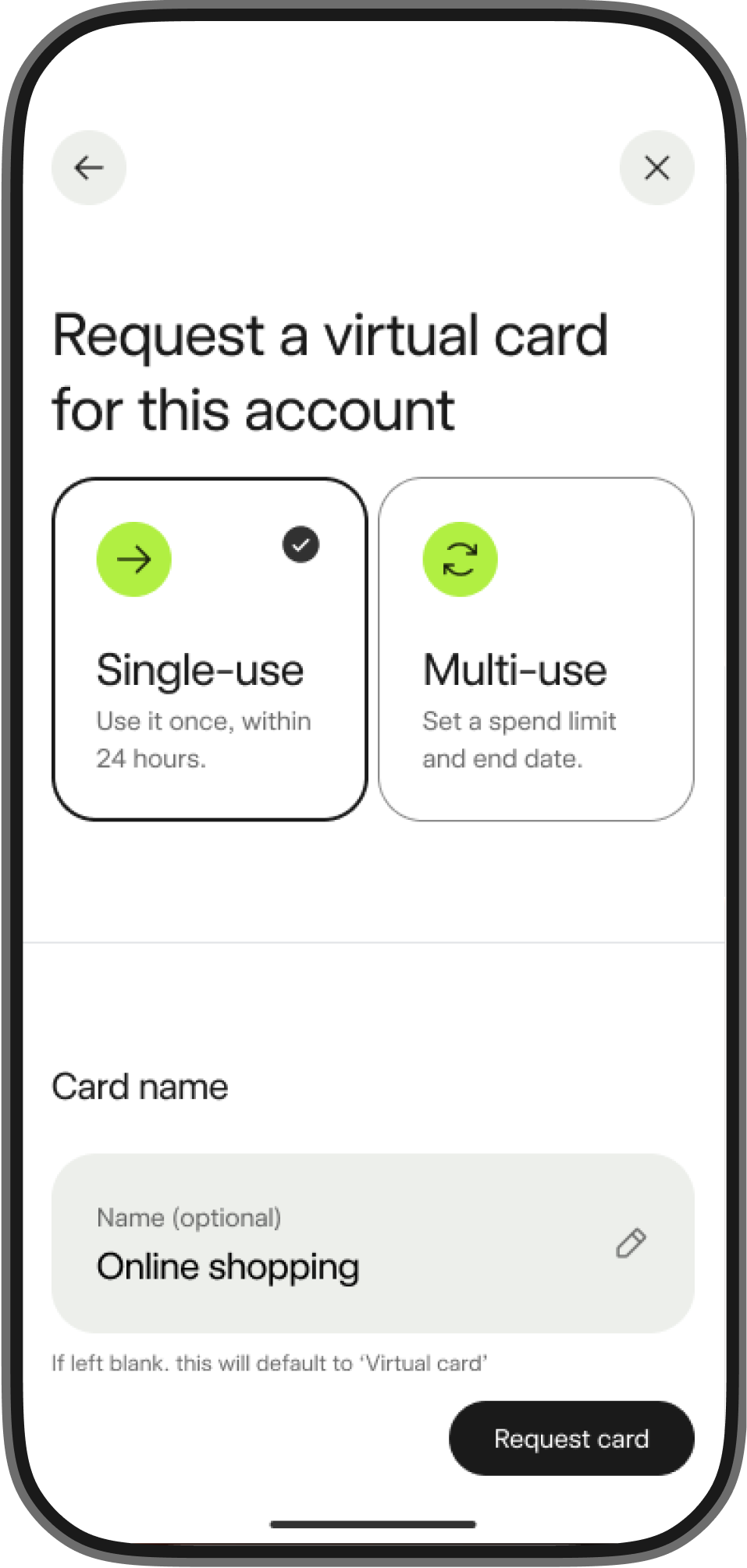

Make purchases without using your regular card details

Helping you spend, worry-free

Use temporary card details so you can spend without sharing your regular card details.

Customise your spending with multi-use virtual card

Nickname your card, set a spend limit and choose an end date to manage multiple purchases, like a holiday or home renovation.

Use it online, in-store and overseas

Add your virtual card to your digital wallet or copy card details to start using it straight away.

Set up in the Bankwest App

Create a single-use or multi-use virtual card in app with any transaction account or credit card.***

Accounts for home and away

No foreign transaction fees

Spend from home or anywhere in the world and we won’t charge you foreign transaction or ATM fees.*†

See your balance in a foreign currency

Switch on multi-currency view in the app to see your balance in a foreign currency.

You get the same foreign exchange rate we get from Mastercard

We don’t mark up or add conversion fees when you use your Bankwest Mastercard overseas.

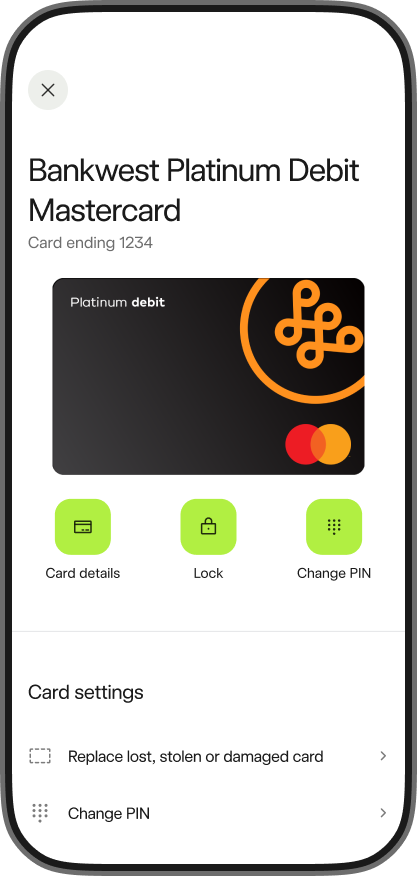

Manage your card abroad

You can lock and manage your card if it’s lost, stolen or damaged.

A truly digital experience

Tap and pay straight away

Add your card details to your digital wallet and start spending straight away with Apple, Google or Samsung Pay.

Card details in reach

View your details in the ‘Cards’ tab at any time.

Accounts for over 55s

Retirement Advantage Account

An everyday bank account that earns interest. Designed for those aged 55 and over.~

Common questions

- Reminders to deposit money to avoid a monthly maintenance fee

- Know about any overseas transactions on your account as they happen

- Reminders for upcoming scheduled payments and your available balance

- PayPass alerts

- Alerts when your account balance falls below, or reaches, a nominated amount

- Alerts when a payment (like your salary) has been made to your account.

See what you’ve spent at a glance by tapping on a transaction to view the business type, location and contact info.

The Bankwest App puts you in control of your card wherever you are. Get access to your digital card details instantly after opening your account. You can lock or replace your card if you loose it, and monitor account activity with ease.

Spending online or in-store

If you have a Platinum Debit Mastercard, you’ll be able to access all the funds in your account if you select ‘Credit’ – as long as the available balance of the account is above the transaction amount.

If you have a standard debit card (without the chip), you can only use it for EFTPOS payments. It can’t be used for contactless or online payments. Your maximum daily EFTPOS limit is capped at $2,000 and can’t be changed.

Withdrawing cash

You can withdraw cash at Australian and overseas ATMs, Bank@Post and EFTPOS terminals up to a combined amount of $2,000 per day.

Things to consider

- Apple, the Apple logo and Apple Pay are trademarks of Apple Inc. App Store is a service mark of Apple Inc. Bankwest Apple Pay Terms of Use apply.

- Android, Google Play and the Google Play logo are trademarks of Google LLC. Bankwest Google Pay Terms of Use apply. Google Pay and Google Wallet are trademarks of Google LLC.

- Bankwest Samsung Wallet Terms of Use apply. Samsung and Samsung Wallet are trademarks of Samsung Electronics Co Ltd.

- Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

# Easy Saver

Must link to an Easy Transaction account. Limit one account per customer – not available for joint accounts.

‡ Offset Transaction Account

Offset Transaction Account must be held in the same name as the loan account. Maximum 40% offset is available with our Complete Fixed and Fixed Rate home loans. Other exclusions apply. Account holders must be 18 years or older. Other fees and charges may apply. Credit interest is not payable on this account. Where a monthly offset fee applies, it will apply to each offset account held. For offset accounts linked to a Fixed Rate Home Loan, no offset fee applies during the fixed term although a $12 monthly loan maintenance fee applies. At the end of the fixed term a monthly offset fee of $10 per offset account will apply.

^ Custom alerts

Custom alerts are available for mobile personal banking accounts on eligible devices in which you have the Bankwest App installed and notifications enabled. Limited alerts only are available for credit products.

* ATM fees

ATM operators may charge a fee. Other fees and charges may apply.

† Foreign transaction fees

Foreign transactions are all transactions effected in foreign currency or occurring outside of Australia whether in foreign currency or Australian dollars including if you are in Australia (for example, online) where the merchant or the financial institution or entity processing the transaction is located overseas. Other fees and charges may apply, including when using overseas ATMs.

~ Retirement Advantage age requirement

For joint accounts, one customer must meet the age requirement.

*** Virtual cards

Eligibility criteria apply. Virtual cards are available, subject to your account meeting the requirements, for Easy Transaction Accounts, Offset Transaction Accounts, Qantas Transaction Accounts, Retirement Advantage Accounts and all retail credit cards (where lending criteria apply). See the Account Access Conditions of Use or Terms and Conditions relevant to your product.