Zero Mastercard.

Zero annual fees

Save on fees with no annual fees.

Save on foreign transactions

No foreign transaction fees for Platinum cardholders. 2.95% of transaction amount for Classic.††

Up to 55 days interest free

Pay no interest on your purchases for up to 55 days.#

0% p.a. for 6 months on purchases and balance transfers.

Limited time, new Bankwest Zero Mastercard customers only. 3% balance transfer fee, plus other fees and charges, T&Cs apply.*

The credit card with low maintenance.

For day-to-day use.

Designed for people who like to pay off their balance each month and avoid higher fees.

Available in Classic or Platinum.

Zero Classic Mastercard

Zero Platinum Mastercard

| Zero Classic Mastercard | Zero Platinum Mastercard |

|---|---|

Minimum credit limit $1,000 | Minimum credit limit $6,000 Higher min credit limit |

Foreign transaction fee 2.95% of the transaction amount†† | Foreign transaction fee 0%†† No foreign transaction fee |

Annual fee $0 | Annual fee $0 |

Interest at a glance.

Breeze Mastercard.

For our lowest ongoing rate.

Available in Classic or Platinum.

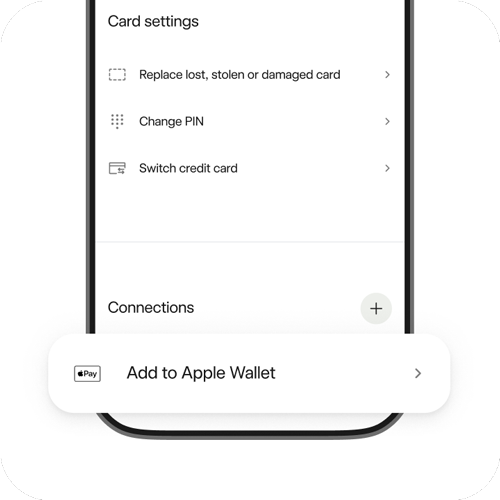

What you get with a Bankwest credit card.

Always in the know.

Security taken seriously.

Spend how you like.

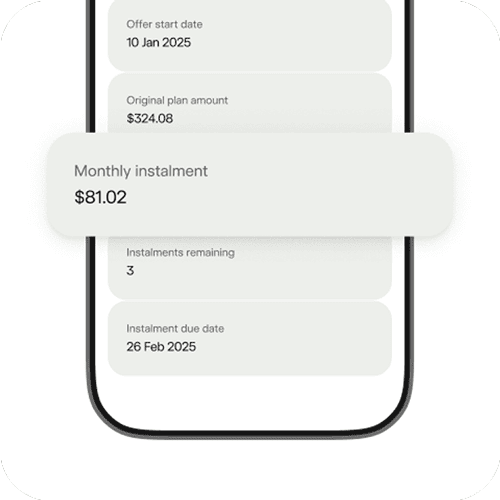

Easy Instalments.

All the details.

Zero Classic Mastercard

Zero Platinum Mastercard

| Zero Classic Mastercard | Zero Platinum Mastercard |

|---|---|

Description For everyday with no annual fee. | Description For everyday with no annual fee. |

| Zero Classic Mastercard | Zero Platinum Mastercard |

|---|---|

Introductory balance transfer rate 0% p.a. for 6 months on balance transfers. Limited time, new Bankwest Zero Mastercard customers only. 3% balance transfer fee, plus other fees and charges, T&Cs apply.* | Introductory balance transfer rate 0% p.a. for 6 months on balance transfers. Limited time, new Bankwest Zero Mastercard customers only. 3% balance transfer fee, plus other fees and charges, T&Cs apply.* |

Introductory purchase rate 0% p.a. for 6 months on purchases. Limited time, new Bankwest Zero Mastercard customers only. Other fees and charges, T&Cs apply.* | Introductory purchase rate 0% p.a. for 6 months on purchases. Limited time, new Bankwest Zero Mastercard customers only. Other fees and charges, T&Cs apply.* |

Bonus points Not applicable | Bonus points Not applicable |

| Zero Classic Mastercard | Zero Platinum Mastercard |

|---|---|

Minimum credit limit $1,000 | Minimum credit limit $6,000 |

Interest free period Up to 55 days# | Interest free period Up to 55 days# |

Points earned Not applicable | Points earned Not applicable |

Points cap Not applicable | Points cap Not applicable |

Lounge access Not applicable | Lounge access Not applicable |

Eligible card as part of Complete Home Loan Package Not applicable | Eligible card as part of Complete Home Loan Package Not applicable |

| Zero Classic Mastercard | Zero Platinum Mastercard |

|---|---|

Complimentary overseas travel insurance Not applicable | Complimentary overseas travel insurance Not applicable |

Complimentary extended warranty insurance Not applicable | Complimentary extended warranty insurance Not applicable |

Price guarantee insurance Not applicable | Price guarantee insurance Not applicable |

Purchase security insurance Not applicable | Purchase security insurance Not applicable |

| Zero Classic Mastercard | Zero Platinum Mastercard |

|---|---|

Ongoing purchase rate 18.99% p.a.^^ | Ongoing purchase rate 18.99% p.a.^^ |

Ongoing balance transfer rate 18.99% p.a.~~ | Ongoing balance transfer rate 18.99% p.a.~~ |

Cash advance rate 21.99% p.a.† | Cash advance rate 21.99% p.a.† |

| Zero Classic Mastercard | Zero Platinum Mastercard |

|---|---|

Annual fee $0 | Annual fee $0 |

Cash advance fee 3% of transaction amount or $4 (whichever is greater) | Cash advance fee 3% of transaction amount or $4 (whichever is greater) |

Foreign transaction fee 2.95% of the transaction amount†† | Foreign transaction fee 0%†† |

Balance transfer fee 3% | Balance transfer fee 3% |

Paper statement fee $1.25 per statement (avoid with eStatements) | Paper statement fee $1.25 per statement (avoid with eStatements) |

Late payment admin fee $25 per statement period¶¶ | Late payment admin fee $25 per statement period¶¶ |

Uncomplicate your banking.

Explore the rest of the line up.

Common questions.

You can make your repayments in the app or online banking. Schedule a repeating payment for a set amount to make this automatic.

You can also call us on 13 17 19 and choose ‘self-service phone banking’ or visit a participating Bank@Post location to make a repayment.

At a minimum, you’ll need to pay off the ‘Minimum payment’ amount specified on your statement plus any ‘Amount Due Immediately’ by the due date to avoid a late payment fee. You can also choose to pay off your entire balance to avoid purchase interest and get your interest free days (if applicable).

Yes – this is known as a balance transfer. You can transfer any outstanding balance from another bank’s credit card to a Bankwest credit card.

You’ll be eligible to apply for a Zero Mastercard if you meet the below criteria:

- You’re 18 years or over

- You’re an Australian permanent resident

- You don’t already have a Bankwest Zero Mastercard, as we only allow one per customer.

Start your application online now. You’ll need:

- Photo identification such as an Australian driver’s licence or passport. Or see a handy list of other ID documents we'll accept.

- Employment details, including length of employment and employer contact numbers

- Info about your income, expenses, assets, loans and other credit cards.

If you have a credit card and you want to add someone else as an additional cardholder, you and the person will both need to fill out and sign the Additional Cardholder(s) Request Form (PDF).

Once you’ve finished, you can send this form to us at:

Cards Services

Reply Paid 8411

Perth BC WA 6849

If the person you want to add as an additional cardholder isn’t already banking with us, we’ll need them to be identified at an Australia Post outlet. See a handy list of ID documents we’ll accept.

Things to consider.

- There is a limit of one Bankwest Breeze Mastercard, one Bankwest Zero Mastercard, one Bankwest Qantas Mastercard, and one Bankwest More Mastercard per customer.

- Rates are subject to change. Other fees and charges may apply. A full list of fees will be outlined in your credit card contract. See the Credit Card Key Facts Sheet (PDF) and visit Terms and Conditions for more information.

- Lending and eligibility criteria, fees and charges apply.

- Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

†† Foreign transaction fees

Foreign transactions are transactions occurring outside of Australia whether in foreign currency or Australian dollars including if you are in Australia (for example, online) where the merchant or the financial institution or entity processing the transaction is located overseas. No foreign transaction fees or overseas ATM fees apply for Platinum or World customers. Other fees and charges may apply, including Overseas ATM operator and local non-bank ATM operators may charge a fee.

# Interest free days

You qualify for interest free days on purchases if you pay the closing balance owing (excluding any promotional or introductory balance transfer amount) on your current statement in full by the due date. Section 24 of our Credit Cards Conditions of Use (PDF) further outlines how this interest free period is calculated.

* Bankwest Zero Mastercard introductory offer

Introductory balance transfer rate offer and introductory purchase rate offer is only available to new Bankwest Zero Mastercard customers who apply from 1 August 2024 until the promotion ends, and are approved. Excludes product transfers from existing Bankwest credit cards.

Introductory balance transfer rate offer and introductory purchase rate offer:

- A 3% balance transfer fee is payable on all transactions to which that balance transfer rate applies

- Introductory balance transfer rate excludes cash advances (rate of 21.99% p.a. applies)

- Applies from the date the card is opened, regardless of when any balance transfer is processed by us

- After the intro period, the interest rate on any outstanding transferred balance or purchase will be charged at the ongoing rate for purchases and balance transfers as outlined in your credit card schedule

- Minimum balance transfer amount is $500

- Only non-Bankwest-branded credit cards can be balance transferred to Bankwest Mastercard credit cards

- A balance transfer request will only be processed up to 95% of your approved credit limit.

^^ The ongoing purchase interest rate

The ongoing purchase interest rate is the rate that applies to purchases after any applicable introductory period finishes.

~~ The ongoing balance transfer rate

The ongoing balance transfer rate is the rate that applies after the introductory period finishes.

† Cash advance rate

Cash advance rate applies to online transfers and using your credit card to withdraw cash.

¶¶ Late payment admin fee

When the minimum payment is not processed by the due date. This includes any amount shown on your card account statement as 'amount due immediately'.

^ Earning Qantas Points

You must be a member of the Qantas Frequent Flyer program to earn and redeem Qantas Points. A joining fee usually applies. However, complimentary membership is available from Bankwest if you join at qantas.com/joinffbankwest. Membership and the earning and redemption of points are subject to the terms and conditions of the Qantas Frequent Flyer program. Qantas Points are earned in accordance with and subject to the Bankwest Qantas Rewards Terms and Conditions (PDF).

Qantas Points are earned on eligible purchases only. Most purchases are eligible purchases except some things such as balance transfers, bank fees, gambling, government charges and anything else listed in section 5 of the Bankwest Qantas Rewards Terms and Conditions (PDF). Exclusions and limitations apply. Points earned and redemption values subject to change.

Qantas Points (outside any bonus points) won't be transferred to your Qantas Frequent Flyer Account until:

- You have spent an initial $1,500 on eligible purchases using your card; and

- Your account has been opened for at least 2 months.

** Complimentary insurance

Complimentary overseas travel insurance provides base cover only. Limitations, exclusions, and eligibility criteria apply. See the Credit Card Insurances Product Disclosure Statement and Information Booklet (PDF) for details.

Coronavirus (COVID-19) Cover is available for overseas medical expenses incurred due to COVID-19. No cover is available under any other benefit or if you are travelling on a cruise. Terms and conditions apply. For more information please refer to the Credit Card Insurance PDS (PDF).

~ Earning More Rewards points

More Rewards points are earned in accordance with and subject to the Bankwest More Rewards Terms and Conditions (PDF). Exclusions, limitations and points caps apply. More Rewards points will only be credited to your account once you have spent at least $1,500 on eligible purchases and your account has been open for at least 60 days.

Annual bonus points will not be available to Account Holders who open a Card Account after 31 July 2023. See Bankwest More Rewards Terms and Conditions (PDF) for more information.

††† Virtual cards

Lending and eligibility criteria apply. See the Account Access Conditions of Use for your product.