How to understand your credit card statement.

Read time 1 min

There's a few different things to consider when looking at your credit card statement, so we've put together a guide on how to tackle them.

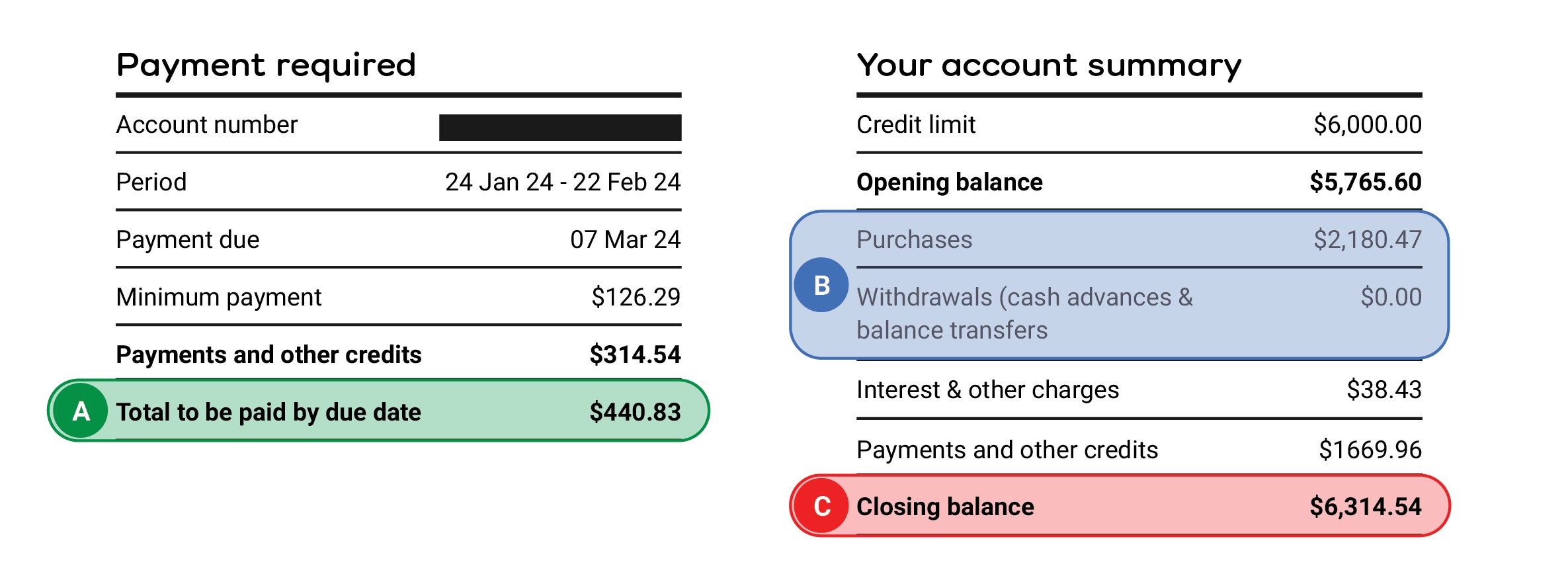

Example of a credit card electronic statement.

Example of a credit card paper statement.

Your statement explained.

A: Your minimum repayment.

The minimum amount you need to pay each month – pay this off to avoid a late payment fee. If there is an amount due immediately, you must also pay that amount to avoid the late fee.

B: Purchases you’ve made.

Any purchases you've made during the payment cycle (since your last statement), including any balance you've transferred from another credit card or cash you've taken out of your credit card account.

C: Total amount you currently owe.

The total amount you currently owe – pay this off to avoid interest.

Things to remember.

If you're struggling to figure out how to avoid fees and interest, remember:

- You need to pay at least your minimum payment plus any ‘Amount Due Immediately’ each month to avoid a late payment fee

- You should pay off your full balance each month to avoid purchase interest

- If you make a cash advance (i.e. withdraw cash from you credit account, or as otherwise outlined in the Credit Card Conditions of Use (PDF)), you’ll be charged a cash advance fee.