How to understand your term deposit statement

There's a few different things to consider when looking at your term deposit statement, so we've put together a guide on how to tackle them.

On This Page

Term deposit statement guide

There can be a lot of info on your term deposit statement, so we've created a simple guide to help you get the most out of it. Let's check it out.

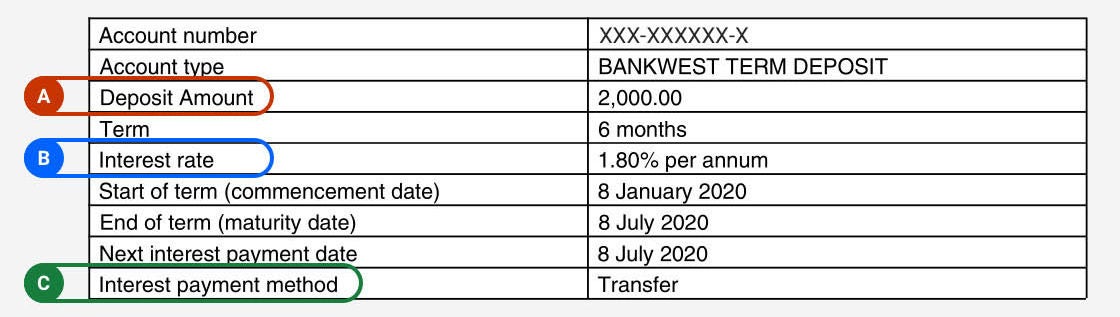

A: The deposit amount is the amount you’ve invested.

B: The interest rate shown is based on the available rate on the day the letter was issued, and it could change at any time.

C: The interest payment method is the instructions for what will happen to the interest earned at the end of your term.

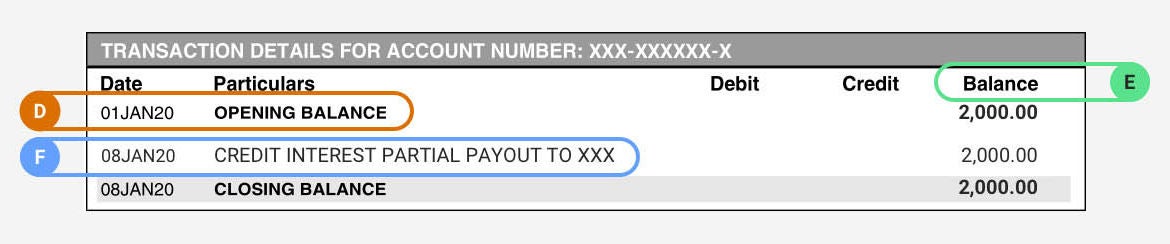

D: The opening balance is your initial deposit. Keep in mind that after the term has started, additional payments won’t earn interest.

E: The balance can be a combination of your deposits and any interest earned (that’s if you’ve opted for interest to be paid into the account).

F: The credit interest earned at the end of the term.

If you need to withdraw money from your account

If it’s during your term, then you can still take money out, just be aware you’ll need to give us 31 days’ notice. It’s something that all banks have to do. Keep in mind that it will affect the interest you earn.