Bankwest Qantas Transaction Account.

No foreign transaction fees

Spend from home or anywhere in the world and we won’t charge you foreign transaction or ATM fees.*†

Tap and pay straight away

Add your card to your digital wallet, then spend instantly with Apple, Google or Samsung Pay.

Make the most of points

Use your Qantas Points towards Classic Flight Rewards, Classic Hotel Rewards or leading brands at Qantas Marketplace.##

The account for the world traveller.

Earn Qantas Points on your spending.

Earn Qantas Points on the money in your account and on everyday spending.

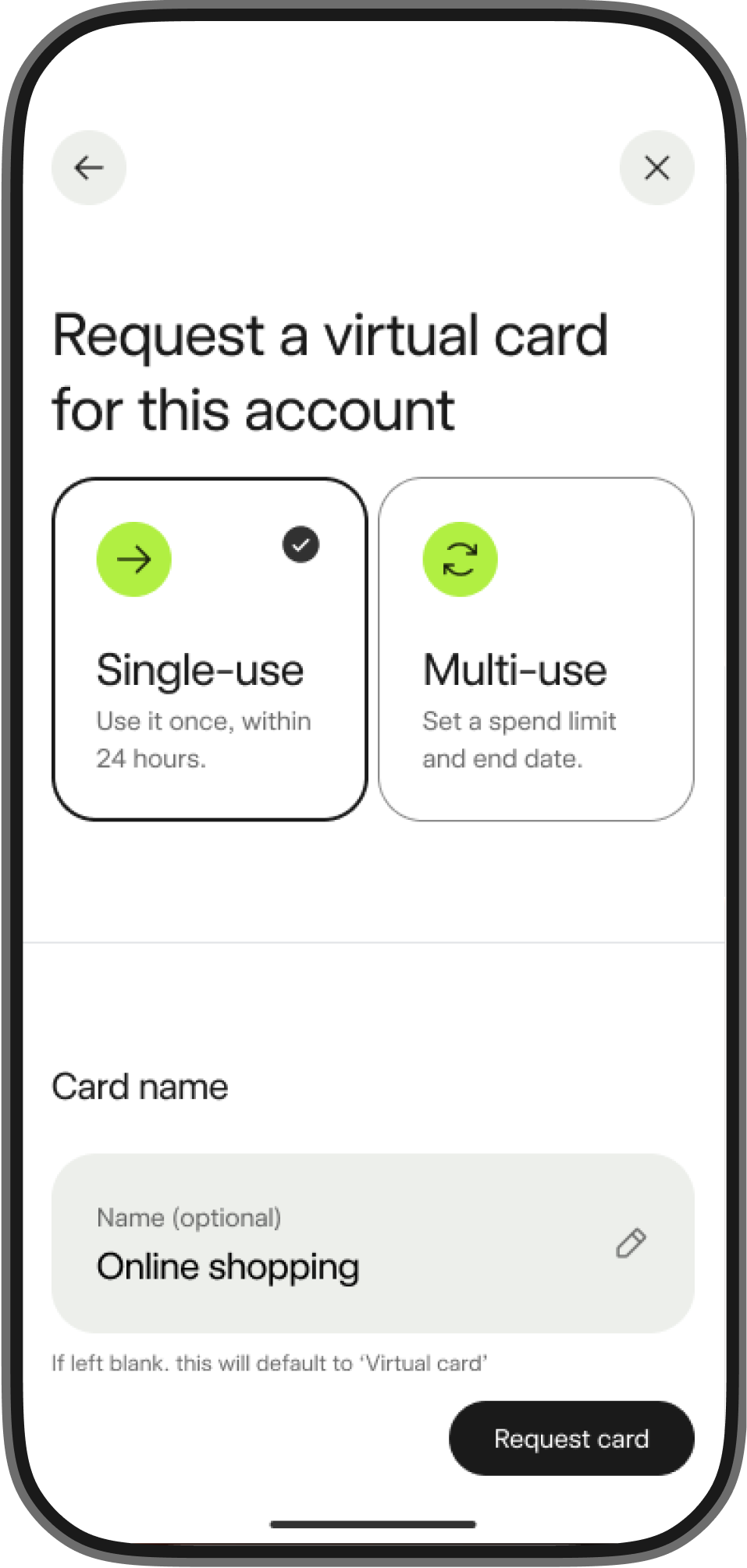

Make purchases without using your regular card details.

No fees when you deposit monthly.

No fees as long as you deposit at least $2,000 a month, otherwise it’s $6 per month.

What you get with a Bankwest bank account.

An app that keeps you in the know.

Accounts for at home and away.

A truly digital experience.

Security taken seriously.

Secure login

Access your account using biometrics (TouchID and FaceID) or PIN from your trusted device.

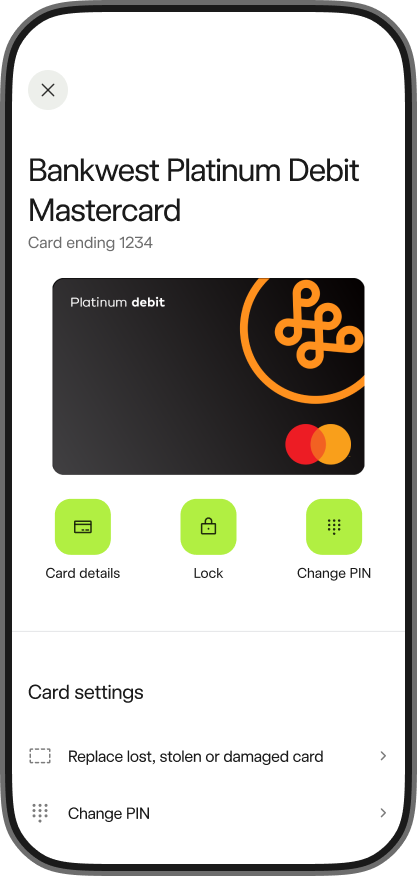

Lock your card from the app

Lock your card if you lose it or spot a suspicious transaction.

See if an account name checks out

When making a first-time payment, NameCheck shows you if an account name likely matches the account details based on our available payment data.

Stay in control

If you get notified of potential unusual activity on your account, you can handle it directly in the app.

Fees.

Monthly maintenance fee |

$0 when you deposit at least $2,000 a month. Otherwise it’s $6. |

|---|---|

| Foreign transaction fee† | $0 |

Uncomplicate your banking.

Common questions.

You can have one Bankwest Qantas Transaction Account per person.

Things to consider.

- Separate app terms of use apply.

- Apple, the Apple logo and Apple Pay are trademarks of Apple Inc. App Store is a service mark of Apple Inc. Bankwest Apple Pay Terms of Use apply.

- Android, Google Play and the Google Play logo are trademarks of Google LLC. Bankwest Google Pay Terms of Use apply. Google Pay and Google Wallet are trademarks of Google LLC.

- Bankwest Samsung Wallet Terms of Use apply. Samsung and Samsung Wallet are trademarks of Samsung Electronics Co Ltd.

- Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

~ Qantas Frequent Flyer

You must be a member of the Qantas Frequent Flyer program to earn and redeem Qantas Points. A joining fee usually applies. However, complimentary membership is available from Bankwest if you join at qantas.com/joinffbankwest. Membership and the earning and redemption of points are subject to the terms and conditions of the Qantas Frequent Flyer program. Qantas Points are earned on eligible purchases only and in accordance with and subject to the Bankwest Qantas Rewards Program Terms and Conditions (PDF).

† Foreign transaction fees

Foreign transactions are all transactions effected in foreign currency or occurring outside of Australia whether in foreign currency or Australian dollars including if you are in Australia (for example, online) where the merchant or the financial institution or entity processing the transaction is located overseas. Other fees and charges may apply, including when using overseas ATMs.

## Redeeming Qantas Points

Qantas Frequent Flyer members only. Other fees charges apply. The redemption of Qantas Points is subject to the Qantas Frequent Flyer Terms and Conditions. You must be a member of the Qantas Frequent Flyer program to earn and redeem Qantas Points.

- Classic Flight Rewards are available on Qantas and partner airlines, are subject to availability, and do not earn Status Credits and Qantas Points.

- Classic Hotel Rewards can only be redeemed using Qantas Points and do not earn Qantas Points. Minimum night stays and blackout dates may apply. Visit Qantas for Terms and Conditions.

- Delivery charges may apply on Qantas Marketplace orders. Visit Qantas Marketplace Terms and Conditions.

^^ Eligible purchases

What counts as an eligible purchase? Most purchases are eligible purchases except some things such as bank fees, gambling, government charges and anything else listed in Section 1 of our Bankwest Qantas Rewards Program Terms and Conditions (PDF).

*** Virtual cards

Eligibility criteria apply. See the Account Access Conditions of Use for your product.

Platinum Debit Mastercard

Platinum Debit Mastercard access is available to Australian citizens and temporary or permanent residents with an Australian residential address. Limited exceptions may apply subject to conditions.

App push notifications

On eligible devices in which you have the Bankwest App installed and notifications enabled.

eStatements

Customers opening this account will receive eStatements via Bankwest Online Banking and the Bankwest App. Customers can opt to receive a paper statement.

Important documents

Consider the applicable PDS available from Bankwest before deciding whether the product is right for you. Fees and charges may apply and subject to change. The relevant Product Schedule together with all of the related documents form the complete Product Disclosure Statement for this product.