Easy Transaction Account.

No fees

Enjoy no ATM, foreign transaction or monthly fees - and no minimum deposit requirements.*†

Tap and pay straight away

Add your card to your digital wallet, then spend instantly with Apple, Google or Samsung Pay.

Get a savings boost

Open a linked Easy Saver account and earn interest on your Easy Saver balance.#

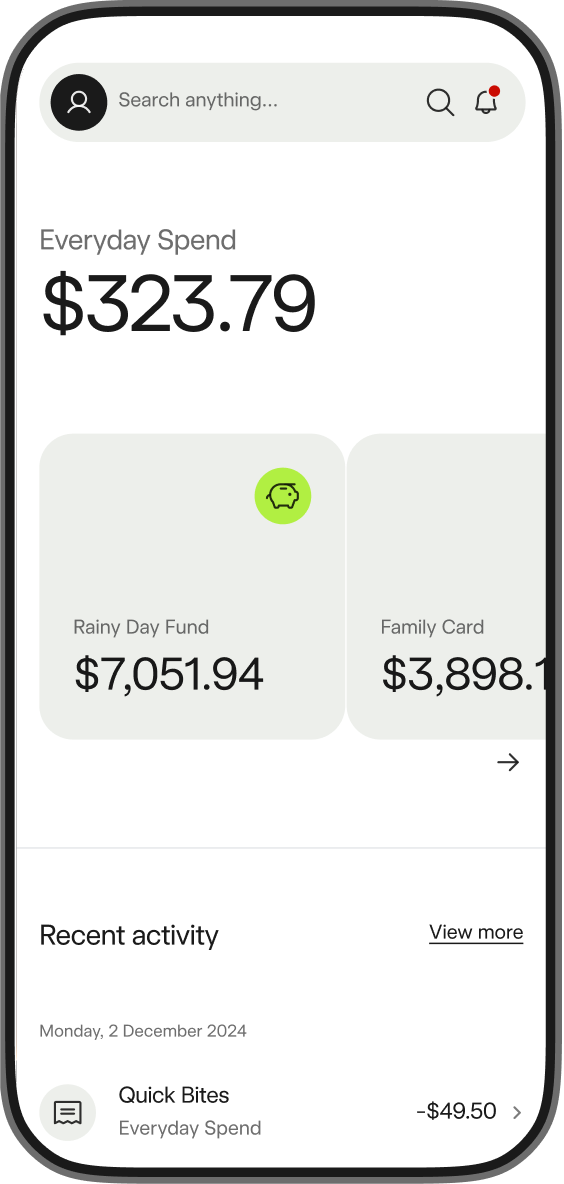

The account for daily spending.

Less to think about.

A simple bank account for the day-to-day to help you stay on top of things.

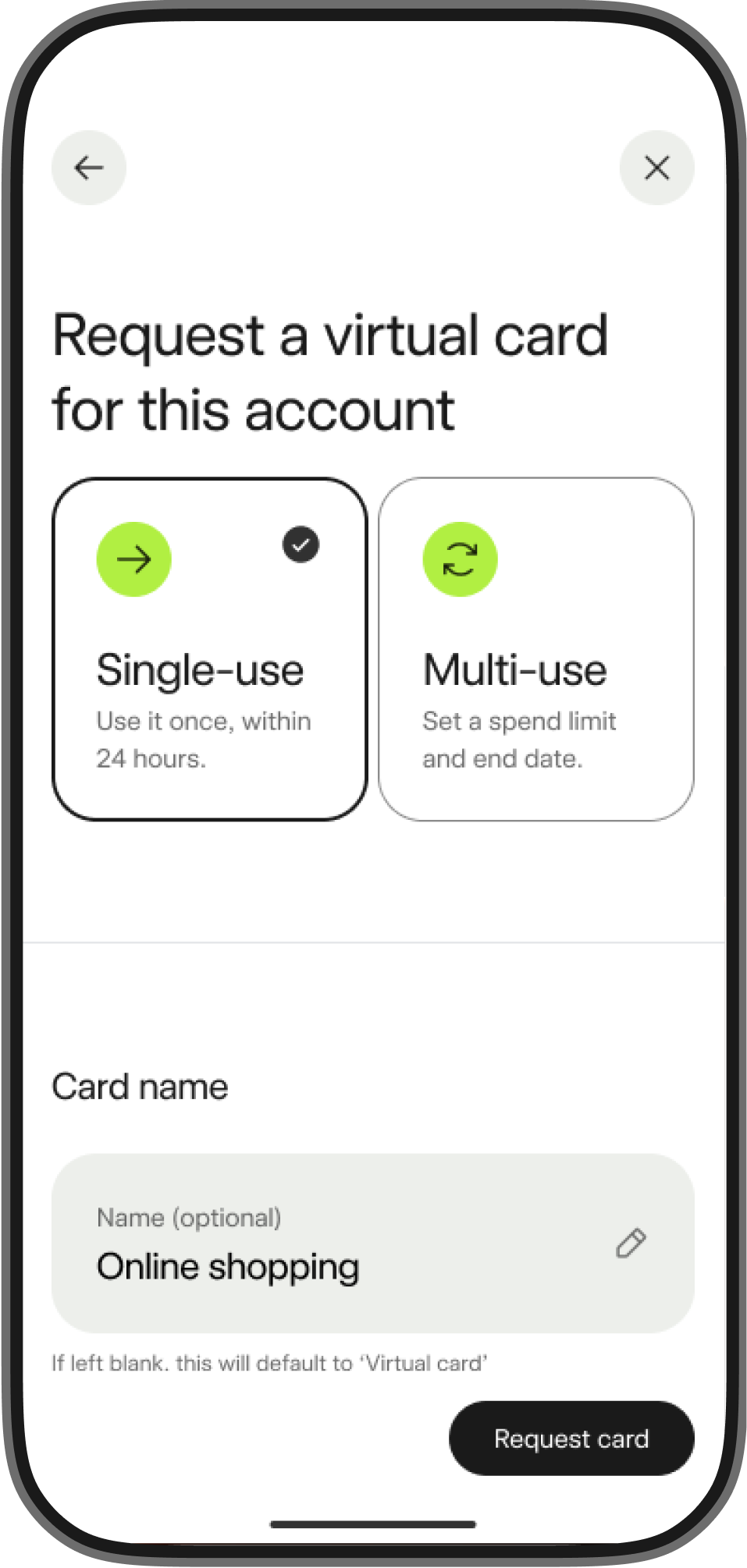

Make purchases without using your regular card details.

What you get with a Bankwest bank account.

An app that keeps you in the know.

Accounts for at home and away.

A truly digital experience.

Security taken seriously.

Secure login

Access your account using biometrics (TouchID and FaceID) or PIN from your trusted device.

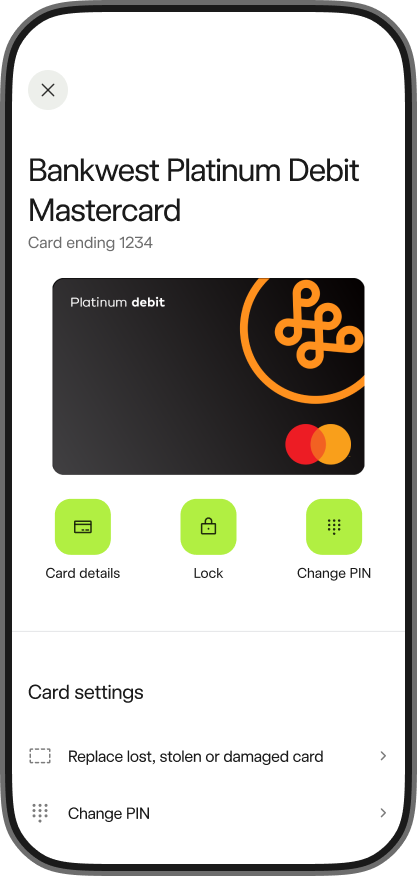

Lock your card from the app

Lock your card if you lose it or spot a suspicious transaction.

See if an account name checks out

When making a first-time payment, NameCheck shows you if an account name likely matches the account details based on our available payment data.

Stay in control

If you get notified of potential unusual activity on your account, you can handle it directly in the app.

Fees.

(There are none).

Uncomplicate your banking.

Common questions.

You can have up to 10 Easy Transaction accounts per person.

If you’re already a Bankwest customer, you may be able to open a joint account in the app by choosing the account you’d like and selecting the ‘two of us’ option.

You’ll need to already have joint Bankwest account(s) with the other applicant, or both applicants must not have any other existing Bankwest joint accounts.

With a joint transaction or savings account, both people will have full access to the account and the money in it unless the account has multiple signatory instructions.

You’ll receive your physical card within 10 business days. Your digital card will appear in the app straight away. Add your card to your digital wallet, then spend instantly with Apple, Google or Samsung Pay.

This is an interest-earning account which doesn’t have BPAY® access or a debit card attached to it, so you can only access the money in it by transferring it to your linked Easy Transaction Account. To open an Easy Saver Account, you need an existing Easy Transaction Account – you can open them both at the same time.

Things to consider.

- Separate app terms of use apply.

- Apple, the Apple logo and Apple Pay are trademarks of Apple Inc. App Store is a service mark of Apple Inc. Bankwest Apple Pay Terms of Use apply.

- Android, Google Play and the Google Play logo are trademarks of Google LLC. Bankwest Google Pay Terms of Use apply. Google Pay and Google Wallet are trademarks of Google LLC.

- Bankwest Samsung Wallet Terms of Use apply. Samsung and Samsung Wallet are trademarks of Samsung Electronics Co Ltd.

- BPAY® is the registered trademark of BPAY Pty Ltd ABN 69 079 137 518.

- Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

† Foreign transaction fees

Foreign transactions are all transactions effected in foreign currency or occurring outside of Australia whether in foreign currency or Australian dollars including if you are in Australia (for example, online) where the merchant or the financial institution or entity processing the transaction is located overseas. Other fees and charges may apply, including when using overseas ATMs.

# Easy Saver

Rates are variable and subject to changes. Interest is calculated daily on a tiered basis depending on your account balance and paid into your account on the first business day of the following month. T&Cs subject to change.

*** Virtual cards

Eligibility criteria apply. See the Account Access Conditions of Use for your product.

Platinum Debit Mastercard

Platinum Debit Mastercard access is available to Australian citizens and temporary or permanent residents with an Australian residential address. Limited exceptions may apply subject to conditions.

App push notifications

On eligible devices in which you have the Bankwest App installed and notifications enabled.

eStatements

Customers opening this account will receive eStatements via Bankwest Online Banking and the Bankwest App. Customers can opt to receive a paper statement.

Important documents

Consider the applicable PDS available from Bankwest before deciding whether the product is right for you. Fees and charges may apply and subject to change. The relevant Product Schedule together with all of the related documents form the complete Product Disclosure Statement for this product.