Here to help.

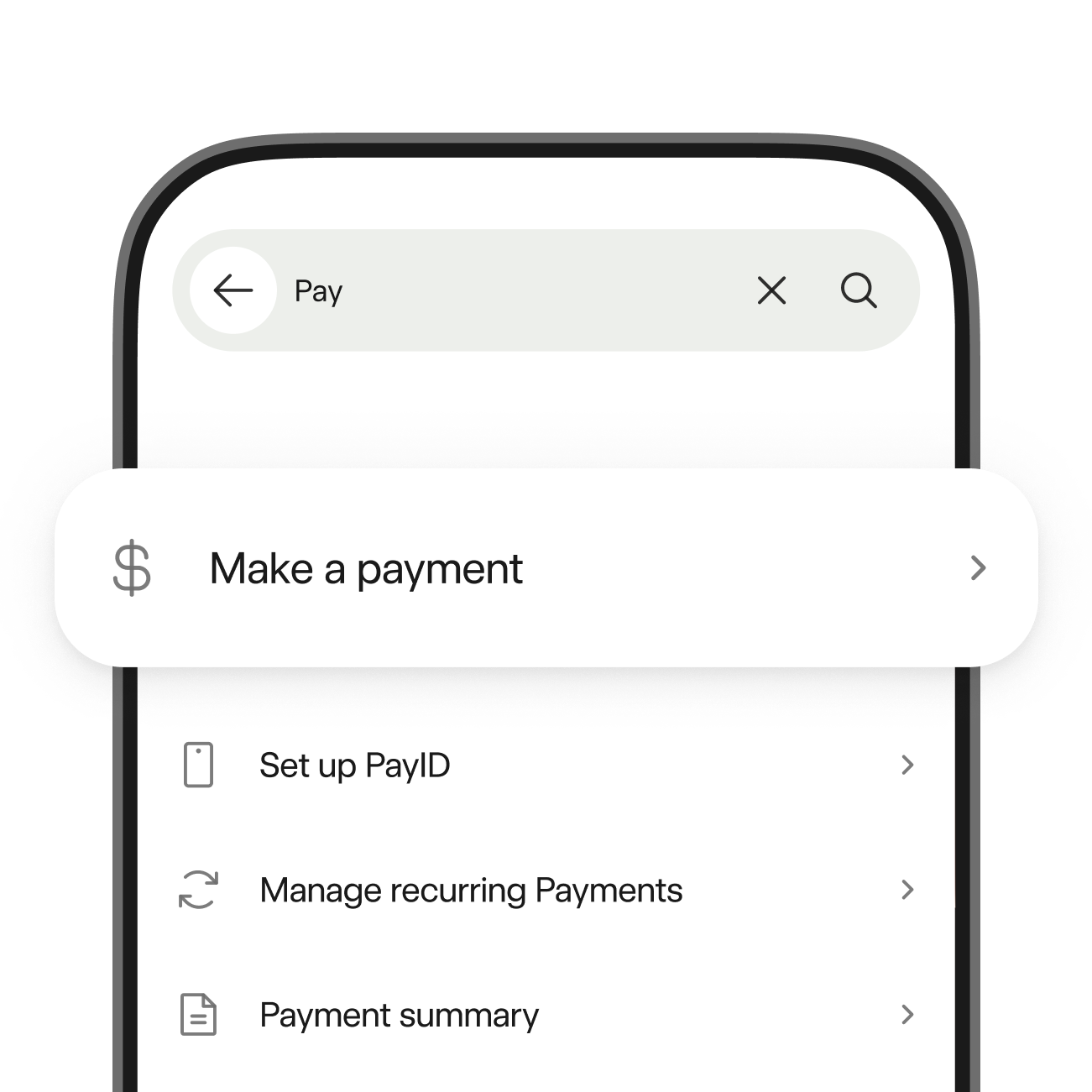

Search for more than just answers.

Use search in the app to find answers and complete actions, like replacing your card, or setup your PIN.

Common questions.

Get answers to common banking questions.

What to do if your card is lost, stolen or damaged.

If your card is lost, stolen or damaged, you can report it in the app and get a replacement. If you’re overseas without access to the app, call us on +61 8 9449 2840.

How to dispute transactions.

If you don’t recognise a transaction on your account, tap on it in the app for more details. Call us on 13 17 19 if you believe it’s suspicious. To dispute the transaction for a different reason, complete the transaction dispute form.

Where to find your Personal Access Number (PAN).

If you’re new to Bankwest, check your email or welcome letter. If you’re already a customer, you can find your PAN in the app or on your account statements.

How to activate your card.

You can activate your card in the app or online banking. If you don’t have access to either, you can also activate by calling 1300 796 844 and following the prompts.

How to change your password.

From the online banking login screen, click ‘Reset your password online’. From the app login screen, tap ‘Forgotten Password’. Then follow the prompts.

How to cancel direct debits or recurring payments.

You can cancel direct debits by messaging us in the app or online banking. To cancel recurring payments, contact the business who charged you.

Support topics.

Browse our help guides by topic.

Guides to help you get the most from your money.

Home loans.

Everything you need to know about buying, refinancing, and making the most of your loan.

Feedback and complaints.

Provide feedback

Let us know how we’re doing. Call toll free within Australia on 1800 650 111.

How to make a complaint

Find out how to make a complaint and what happens next.