Latest scams.

On This Page

Common scams

Investment scams

An investment scam involves either an email or celebrity endorsed social media ads (such as Facebook, WhatsApp etc) that encourages you to invest money or buy cryptocurrency (e.g bitcoin).

Scammers sometimes build relationships with their victims to gain trust and rely on you not doing your due diligence when making the investment. They sometimes offer a small return on your initial investment to put you at ease.

Here’s what to look out for:

- Emails or ads asking you to click on a link

- Prompts to enter your personal and bank details

- Direct messages from people on social media asking you to invest

- Someone claiming to be a broker but not providing their Australian Financial Services Licence and/or not able to meet in person or on video

- Facebook posts tagging people that feature a photo of a celebrity

- Dashboards showcasing fake returns – scammers can use real investment trading platforms to set up fake accounts and appear legitimate.

Important tips

- If the email, SMS or call sounds too good to be true – it usually is

- Beware of offers that sound legitimate but are low-risk, have a seemingly high return and put you under time pressure

- Beware of people posting on social media with links or attestations to celebrity endorsed investments (often cryptocurrency)

- Typical investment scams include real estate and property projects, superannuation, share and stock promotions, foreign currency and binary trading

- Check the individual you are dealing with has an Australian Financial Services licence or look them up on the Australian Securities and Investments Commission. Scammers may impersonate legitimate financial investment firms.

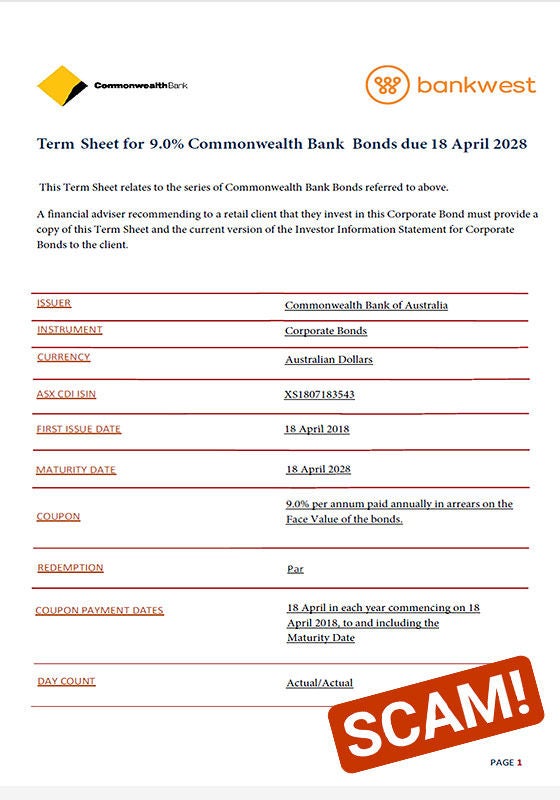

Impersonation scams

Scammers impersonate genuine institutions using marketing materials with company logos, as well as staff names and their departments, to gain access to your bank accounts, have you approve transactions or changes to your account, or offer investment opportunities.

Scammers often lead with competitive rates and include fake offer-ending dates to create a sense of urgency. Confirm legitimacy by checking the organisation’s website or contacting them directly.

Here’s what to look out for:

- Unsolicited emails that offer investment opportunities from fake email addresses

- Personalised links and/or pop-ups on websites and social media

- Investment rates that seem too good to be true and have an end date

- Attempts to gain your trust, with suggestions of what to say to your bank

- Requests for multiple payments to be made as ‘deposits’ to set-up an account

- Requests for personal banking details, including your account details, password and one-time step-up code.

Phishing scams

Phishing email and smishing (SMS phishing) scams use threats of fines, unpaid bills or fake transactions to get you to act quickly, encouraging you to provide your personal information without thinking about it.

They often pretend to be from larger, well-established organisations to gain your trust and will attempt to steal your online banking logins and credit card details or trick you into making a transaction. These look like a genuine email or SMS and can also contain links or attachments leading to malicious software or fake websites – often asking for personal information.

Steer clear of emails or SMS with:

- A sense of urgency where there is a penalty for not taking action

- False payment or refund messages such as “ATO – You have received a refund of $5,000”

- Poor spelling or grammar and similar (but not quite right) email addresses, names, logos and URLs

- Messages asking you to urgently verify your account or log in to pay a bill or fine

- Requests from overseas asking you to forward money or letting you know that you’ve won a prize

- Request to make unusual payment methods, such as gift cards or multiple accounts

- Links that don’t match the genuine organisations web address

- Requests to hand over personal details including a one-time SMS or email code

- Unfamiliar postal, delivery or courier services

- Requests to renew subscriptions.

Scammers will use phishing methods throughout the year (from LinkT, Medicare) as well as targeted seasonal campaigns where we need to be extra vigilant. (e.g. ATO, delivery scams).

See a list of some phishing scams under ‘Other scams’ section.

Important tips

- Contact organisations directly using details from their website – don’t use those supplied in an email or SMS

- We’ll never ask you to disclose, update or confirm personal or banking information in an email or SMS

- We’ll never send you a direct link to online banking

- Before clicking a link, hover your mouse over it to see where the URL will take you

- Never open an attachment you weren’t expecting, especially if it’s attached to a suspicious message.

- Always navigate to online banking and other websites yourself (don’t use links in emails or SMS) so you know they’re genuine.

Romance scams

Romance scammers hide behind fake online profiles which are designed to grab your attention. They gain your trust over time. Once they have this, they’ll try to manipulate you into believing they have health issues, family problems, travel expenses or other personal issues. They’ll usually ask for financial assistance or gifts and can be very convincing. It can be easy to believe they’re genuine because they’ve taken a long time to build a relationship with you.

Warning signs

- Fast and intense declarations of love

- A preference to communicate through email or instant messaging rather than an official dating platform

- A change from affection to desperation or threats if you don’t meet their requests

- They’ll usually make a small request first to test if you’ll comply with a bigger request later

- Preying on a vulnerability such as isolation, age or language barrier.

Remote access scams

These scammers aim to access your computer or device from a remote location to get your personal information. They’ll give a fake but credible story as to why they need it. Watch out if you’re contacted by someone claiming to be from a bank, phone company, government agency or computer software company needing to reset your password, verify your account, update security settings or improve your internet connection.

Important tips

- Never provide remote access, personal details or login details to anyone – especially if they’ve cold-called you

- If you think the caller is genuine, call them back on a number listed on their website – don’t call them on a number they give you

- Watch out for unusual pop-up screens claiming your computer is locked or has a virus

- Don’t use the details or visit the link from the message you’ve received as it’s likely fake

- Make sure your computer has up to date anti-virus software installed and run regularly.

Job scams

Job scams aim to get your attention with a lucrative job opportunity that requires little effort and guarantees employment – for a fee. Once you pay the fee, you might not get any job offers or won’t be paid for the work you complete. Other job scams could put you at risk of breaking the law. A scammer might ask you to accept money into your bank account before moving it to another account (and paying you for allowing this). Criminals use this method to illegally move and launder money, by making you a ‘money mule’.

Warning signs

- You need to pay an upfront fee to get access to the job opportunity

- The opportunity might be to ‘work from home’ and get paid a ‘guaranteed’ income

- You don’t need to be interviewed to qualify for the job

- You’ve been contacted by someone you don’t know about the opportunity

- You’re asked to accept money into your account and then forward it elsewhere.

Other scams

A mail delivery scam attempts to access your card details via email and SMS by claiming to be from a postal delivery service. The email prompts you to pay for shipping costs for a parcel delivery, providing a link to a fake website which asks you to enter your card and personal details. Phishing websites are designed to look like legitimate companies, but have a different URL (hover over the URL to check the full address and check to see if there is a padlock next to https).

The SMS version of this scam claims that a parcel has been kept at a sorting office for you. It also contains a link to a fake website to try and prompt you to pay a fee to release the parcel. If you receive either of these messages, don’t click on the link or respond.

These texts come from ‘ATO’, ‘GOV’ or ‘MyGov’, with suspicious links to more information.

Ensure you log into your MyGov account from the website and not the link, and ignore the sense of urgency to provide your details that scammers create.

Phone spoofing involves scammers hiding their identity by replacing their number with another number, so that you believe you’re being contacted by a recognised caller.

The callers will often say they’re from a security team, and that they’ve detected fraud on your account or need your help to catch a scammer.

Remember – we’ll never ask you for any of your banking details or login info, or to download anything. If you’re concerned, call us on a verified number from a genuine source like our website.

NBN calls

An example of a cold call scam, this involves receiving a call from scammers claiming to fix your NBN and asking for remote access to your computer or internet connection to help fix the problem. What the scammers will be doing is trying to have you log onto your online banking and transfer funds from your account. End a call if someone asks you to give them access to your devices and contact us immediately.

ATO calls

Common around end of financial year, this is where scammers call you claiming to be from the ATO. They may ask you to provide your personal details for verification, notify you of an outstanding debt, or request bank account details for payments or refunds. They may also threaten you with prison if you don’t provide details. Be sure not to provide any information and report it directly through the ATO website.

Scammers email or SMS you pretending to be from Amazon, asking for a refund and prompting you to give your card details. Be sure not to provide any information and report it directly through to Amazon.

If you’ve followed any of these links or think a scammer has your details, get in touch with us immediately.

Scammers pretend to be a part of our fraud department, to help with an internal investigation.

They ask you to confirm the amount of money in your account and to withdraw cash to deposit at another bank. The scammer also asks you not to speak to anyone, so you don’t tip off the employee being investigated.

If you’ve received a call like this, don’t provide any of your details. If you already have, call us on 13 17 19 immediately. Remember, we’ll never ask a customer to participate in an internal investigation or transfer money to another financial institution on our behalf.

This email comes from an unauthorised source posing as us with the subject line such as ‘Bankwest Suspension Notification’. Once opened, it asks you to fill out an attached form which provides the scammer with your details.

If you’ve received an email like this, don’t open the attachment or provide any of your details. If you already have, call us on 13 17 19.

These emails come from scammers posing as us, attempting to lure you into providing your bank details by clicking on specific links.

These emails could ask you to click on a link to avoid having your card suspended or asks you to log in to online banking to see a new ‘SecureMail’ message.

If you’ve received emails like these, don’t click the links or provide any of your details. If you already have, call us immediately on 13 17 19.

This phishing scam targets users on accommodation sites like Booking.com. People receive a message from official website email addresses like ‘noreply@booking.com’ or from the messaging function within the booking app, claiming that a booking will be cancelled if they don’t input credit card details through a provided link.

The message or email is typically received when a customer has recently booked accommodation, is due to check-in, or has already checked in.

If you’ve received a message or email that doesn’t seem genuine or includes an urgent call to action, don’t click the link or share any personal information.

Scammers claim that your Bankwest card is blocked and ask you to click on a link to unblock it. The link takes you a fake version of online banking, which takes your details after you log in. It then shows a form asking for some personal and account info.

If you receive a message that doesn’t appear genuine or includes an urgent call to action, don’t click on the link or share any personal information.

Important links

Lost or stolen card?

If your card is damaged, lost or stolen, you can report it to us easily in the app or call us.

Contact us

Call us on 13 17 19

Call us if you’re concerned about possible fraud.

Call us on +61 8 9449 2840

Call us if you need help from overseas.

Email us

Forward the email to abuse@bankwest.com.au.